“I would like somebody, anybody,

to fight for me – the middle class of London and the South East.... As a

standalone entity, the people of Berkshire, Buckinghamshire, Sussex, Hampshire,

Kent, Oxfordshire, Surrey and London are 18th in the global GDP league, just

ahead of Indonesia and just behind Turkey. If you took this region out of the

UK economy, it would be called Ethiopia...The subsidy from London and the South

East to the rest of the country is truly astonishing...This area needs its own

party. It needs a leader who believes that the striving classes in the South

are overtaxed and overburdened”. (Kelvin MacKenzie, Telegraph 2 December 2012).

"You can't revive the regions

just through handouts from Whitehall…Revenues from the financial services sector

were recycled round the rest of the country through the long arm of the state,

creating the illusion of strong, national growth. Jobs were created but in an

unbalanced way, over-relying on the public sector, funded by tax receipts from

the City of London. And we've seen what happens when the conveyor belt breaks,

as it did spectacularly in 2008. Those tax receipts fall, the money stops

flowing and the whole country feels the consequences as the public sector

contracts and jobs are lost. This nation is made up of 100,000 square miles. It

cannot rely so heavily on one." (Nick Clegg, October 2012)

A financial crisis will always lead to greater competition

over resources, and so the steady flow of news articles about the ‘unfair’ subsidies

received by the regions is of no great surprise. Neither is the response from the

condottieres of the Thatcherite Right like MacKenzie who have seized upon such

reports to invoke a new moral language which asserts regional proprietorial rights

over revenue streams and laments the distorted incentives which encourage an

indolent North to live off the efforts of hard-working Londoners; all highly

emotive in these austere times. In Nick Clegg these defenders of the brave

South have found a Parliamentarian from the North willing to carry - and

embellish - this story. Similar tales are told across Tory and Labour front

benches; and within the metropolis, certain progressives and conservatives are

united in their belief that the North has had it a bit too easy for far too

long.

But as Londoners and their informal representatives look on jealously

as the bank notes disappear over the Watford horizon, it is perhaps worth

revisiting this argument. And it is a complex issue that deserves balance and open-mindedness

to understand the diversity of flows in a national economy.

It is a story that we have touched on in the past. In a

previous paper titled Rebalancing

The Economy we emphasised the importance of the state and para-state as a

source of Gross Value Added (GVA) and employment growth in the regions. We also

noted the growing GVA per capita relative to the national average in London and

to a lesser extent the SE, and the growing presence of financial services GVA

in London relative to the national average. So, in a very simplistic way using

static data there is a degree of truth in the claim that private sector

surpluses generated in London and the South East were recycled as public sector

jobs in the regions. But this is to put arithmetic to a very basic misuse.

This story ignores the general

problems of a national business model that relies less on the manufacture

of things and more on the manufacture of credit. It is a startling fact that

the real value of housing equity withdrawal under Thatcher and Blair was

marginally larger than the real value of GDP growth, suggesting that for our

national economy to grow we require free flowing credit pushing against asset

prices which can quickly and easily be cashed out. It is within that context

that we should perhaps understand the current attempts by the Bank of England,

the State and its various exigencies to prop up house prices by keeping

interest rates low, and by encouraging lenders to avoid repossessing properties

where households are in arrears on their mortgage. This nervousness about

feedback effects and the fragility of the finance sector shows what a truly

sorry state of affairs we are currently in. And it is a state of affairs that

can be directly traced to the attack on industry by the Thatcher government

which has left us with a kind of modern day credit-based equivalent of

Eisenhower’s military-industrial complex of the 1960s and 70s.

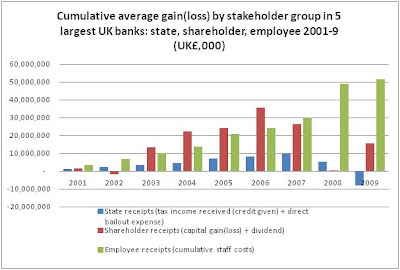

Perhaps more importantly this Londo-centric story also

ignores the vast public costs of underwriting the capital’s financial services

sector: by

our calculations, the Treasury received taxes of £203 billion over five

years up to 2006/7, which were substantially less than the cost of the UK bank

bailouts, estimated at between £289 billion to £1,183 billion by the IMF. So

Clegg is fundamentally wrong on this issue: the banks are a net recipient of

State funds which the whole country must pay for, even though the private gains

are largely realised in London and the SE. From this perspective, we, in the

North, have also seen our bank notes disappear over the Watford gap to keep

well-heeled investment bankers in a manner to which they are accustomed.

This might sound like cheap point scoring, but beneath it

lie subtler questions about the direction of the financial subsidies in a

national economy. Is a reliance on State support the preserve of the North, as

Clegg and MacKenzie suppose?

It is possible to deconstruct London’s success differently.

Global cities like London do attract capital, but they do so because they are a

kind of conversion machine, taking national and international assets,

converting them into revenue streams from which well placed individuals skim

high pay. London attracts capital because it is also extractive in other words. This can be seen from investment

banking to private equity to infrastructure PFIs. This process of extraction

requires an active state, through bailouts and subventions in the banking

system to the underwriting of risks in infrastructure PPPs and PFIs. This implies

the centrality of the state to a proportion of the UKs private sector.

PPPs and PFIs are a good example of where ‘extraction’ has

distinct regional effects. The decomposition of activities around a

contracted-out infrastructure project leads to a fragmentation of corporations

around specialised functions, so that one company may provide the finance,

another may build the school or hospital, another may manage the asset etc etc.

In theory some of these functions need not be located on the site of the

project. And certainly the revenue streams do not all circulate regionally: the

finance company probably has its operating office in London, as might the asset

management office. Even the operations might be co-ordinated from London using

local contractors on site. Overseas companies that invest in PPPs/PFIs are

likely to have an office in London, and those senior workers are likely to be

extremely well paid.

Before PPPs and PFIs, projects that were State funded had

revenue streams that would congeal in the regions where those projects were

based, kicking in multipliers that would further benefit the local economy. The

fragmentation of activities has led to a concentration of certain functions like

financing and asset management in London. This has diminished capacity in the

regions through the withering of broad competences, the fragmenting of supply and

project chains, and skills drift as talent is forced to relocate down South to

find a job. State-sponsored investment projects across the country have

benefited private sector growth in London and the South East.

But infrastructure projects are not just about where the

revenues go, but what liabilities are taken on to generate those revenues; and

crucially who assumes responsibility for those liabilities when things go wrong.

Many PPP/PFI schemes are highly levered: before the crisis projects were

financed on around a 90/10 split debt to equity, though this has now levelled

down to around 70/30. Even so, leverage produces interest payments that require

servicing and a manifest risk of default. So the flipside to the revenue

streams clipped by metropolitan elites is a tower of hidden contingent

liabilities that may be passed onto the State, as when NHS Trusts cannot repay

their PFI loans. Similarly on the operations side, contracts which allow

companies to exit their obligations (designed to attract initial bidders) may

leave the State with unexpected costs. This is what First Group did when it walked

away from the backloaded premium payments on its First Great Western

franchise, costing the taxpayer an estimated £800m in lost receipts. On the

contracting side, unwieldy contracts can produce inefficiencies and exorbitant

penalty clauses which are costly to renegotiate. And this is before we discuss the

many contracts that overshoot their original estimates. All of these interventions

should be thought of as State subsidies; received mainly by private subsidiaries

operating in the capital, and paid for by taxpayers the length and breadth of

the country.

This quiet cross-subsidy from North and West to South East has

been running un-noticed for a long period of time. Its unanticipated result is a

kind of regional moral hazard: the metropolitanisation of gains, and the nationalisation

of losses.

So returning to the question of fairness and national cross

subsidies: it strikes me that Kelvin MacKenzie is the kind of odious character

who, had he been alive in Biblical times, would have written a sneering

editorial about the ‘beggar’s charter’ created by the actions of do-gooder

Samaritans. He will therefore understand this dilemma about regional moral

hazard because London receives a subsidy that is not paid for by Londoners. If

we are to resort to the kind of petty proprietorial politics that MacKezie and

Clegg espouse, then let’s get one thing straight: if they’re London’s revenue

streams, they’re London’s liabilities too. So next time, when the banks blow up

or another PFI deal hits the wall, the liability costs should fall on the

shoulders of Londoners and the South East alone. Let those metropolitan

taxpayers bail out the banks. Which political party or mayoral candidate could

fail to get elected on that platform?

Stanley