Recent concerns about Deutsche Bank’s financial position

highlight again that banking remains fragile. On Friday Deutsche Bank’s shares fell

nearly 9% at the opening bell as investors panicked about news that hedge

funds had started to pull business from the company. This comes off the back of increased concerns

about potential writedowns and the vulnerability of its coco bonds at the start

of the year.

The immediate trigger for this most recent panic is a $14bn

demand by the US Department of Justice to settle allegations related to the

mis-selling of mortgage backed securities & CDOs during the 2000s boom. This

comes after several other large banks settled similar cases with the DoJ: Bank

of America paying a $16.65bn

settlement for activities undertaken by it and its subsidiaries including

Merril Lynch and Countrywide Financial Corporation, JP

Morgan paying $13bn and Citigroup

$7bn. In some cases the fines

eventually paid were significantly less than the original sum demanded by the

DoJ. There is hope within Deutsche Bank that a similar deal can be struck and a

lower amount paid, with recent estimates venturing that the figure could be closer

to $3-4bn.

But Deutsche Bank’s bargaining position with the DoJ may be

hampered by the specific detail of its activity in RMBS and CDO markets

during the boom. Unlike US banks, Deutsche Bank ran a more vertically

integrated model of securitization (Exhibit 1) which meant it occupied a different space in

the market compared to its competitors. By integrating trustee,

listing and other administration functions (which are provided by external parties in most US CDOs) the DoJ will have to consider

whether Deutsche Bank’s larger footprint potentially gave it a knowledge advantage.

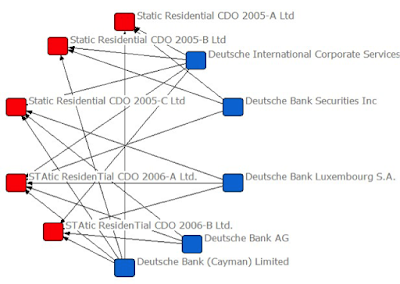

Exhibit 1: Deutsche Bank entities co-participation in CDOs. Line thickness = #of joint products (values given); size of node = #of CDOs involved with.

To illustrate the point, with the STAtic CDOs that featured heavily

in the Senate report on the causes of the financial crisis (373 f. Footnote

1505), either three or four Deutsche Bank entities were usually involved in

their structuration: DB’s Irish Deutsche

International Corporate Services Ltd., its Cayman Deutsche Bank (Cayman) Ltd., its American Deutsche Bank Securities Inc., Its Luxembourgian Deutsche Bank Luxembourg S.A. and Deutsche Bank (Exhibit 2). These

positions were mainly occupied by independent providers in the case of US bank CDOs. Not only that, but Deutsche Bank also sold

these services to other market participants (Exhibit 3).

Exhibit 2: Deutsche Bank entities involved in START CDOs

Exhibit 3: Comparison between Deutsche Bank entities and

other major US banks involved in the CDO market

The DoJ will have to consider whether Deutsche Bank’s vertically integrated model gave it access to more information about the quality of the due diligence and thus the underlying collateral in the CDO market. If it believes Deutsche Bank’s structural position meant its employees did know more than their competitors, then - given the febrile context - it might now be financially prudent to consider jail time for the individuals involved rather than fines for the institution.